The Value Investing Guide to Valuation system with Chinese characteristics——“Winning Investment: Code to fortune-VMMIG model”

“Winning Investment: VMMIG - the code to Wealth” is the first value investment guidebook in China dedicated to the “Zhongtegu” (Chinese characteristic valuation system). The author leverages 30 years of accumulated experience in Chinese and Western financial education and capital market practice to explore an investment system with Chinese characteristics and build the easy-to-understand/useful “VMMIG” valuation model, stock selection criteria and risk control strategy that corresponds to Chinese features.

Content Overview

(Warren Buffett, renowned value investor)

The first chapter “Story of a tiny grain of rice” talks about investment ideology. It starts with the fable of the fisherman and the king, and explains in detail the magic wand of compound interest, three-part theory, Chinese public’s misunderstandings about value investment, the idea that investment is to invest in the fortune of the country, and how to invest across cycles.

From the second to the sixth chapter, the book discusses a value investment system and methodology with unique Chinese characteristics. It elaborates on the “VMMIG Model” from five dimensions: Valuation, Market, Management, Industry, and Growth.

The seventh chapter, “VMMIG – The Code to Wealth”, discusses the scoring system of VMMIG, the value investing model with Chinese characteristics. It provides examples for scoring for 60 companies in 20 segmented industries and elucidates the crucial risk control concept of VMMIG.

Expert Recommendations

Author Introduction

“A tiny grain of rice can achieve the revolution of wealth”

--Qi Kezhan

Qi Kezhan is the founder, president, and chief investment officer of Merger China Group(MCG), holding a Ph.D. in Economics and an MBA from Columbia University. He previously served as the Managing Director of China International Capital Corporation, and he has worked at BCG and Goldman Sachs headquarter in New York. He is the author of “The Borders of Capital” and translated “Merger Masters: Tales of Arbitrage” and “Crisis and Recovery.” He is a columnist for Caixin Media and has been responsible for projects that received the accolade of “Best IPO” by “Caizhi” magazine and “Securities Times” from 2010 to 2012.

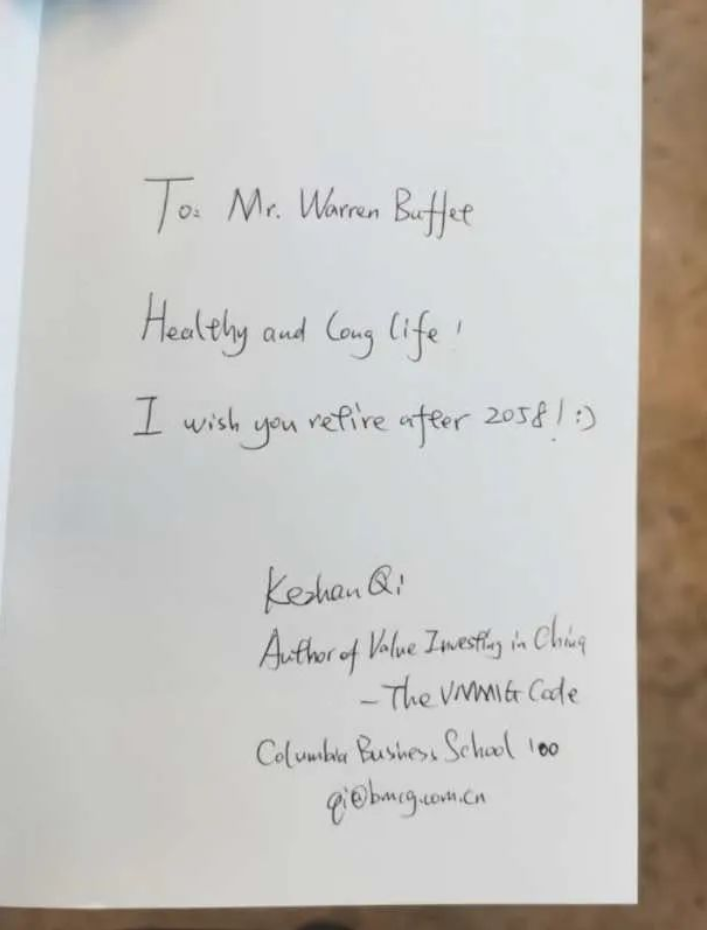

Dr. Qi conceived the idea of writing a book on “Chinese Grassroots Finance” in 2013, when MCG was founded. He has been steadfast in attending the Berkshire Hathaway Annual Shareholders Meeting in Omaha every year. As a native Chinese, along with his foundation in finance that stemmed from studying at Columbia Business School in the late 20th century, as well as his experience in Wall Street and the Chinese A-share market over the past decade, and in addition to his attentive observations at the Berkshire Hathaway Annual Shareholders Meeting for the past ten years, Dr. Qi has an in-depth, intuitive, systematic, and comprehensive understanding of the value investing principles of Graham, Buffett, and Munger, as well as the unique characteristics of China’s market economy and capital market system.

(Dr. Qi presented this book to Warren Buffett, his senior, when he attended the AGM this year)

Additionally, Dr. Qi has translated two classic works in the field of finance. The first one is the collection of classic writings on crisis management and economic recovery by former Federal Reserve Chairs Greenspan, Bernanke, and Yellen, titled “Crisis and Recovery.” It covers the 1997 Asian financial crisis, the 2008 global financial crisis, and their insights on handling financial crises and achieving economic recovery. Fortunately, Bernanke was honored with the Nobel Prize in Economics for his exceptional contributions to the theory of financial crises. The second book is “Merger Masters: Tales of Arbitrage,” co-authored by renowned value investor Mario Gabelli and former editor-in-chief of Barron’s, Alan Weil. It features 20 Wall Street merger masters and CEOs, presenting classic case studies and life insights in the field of mergers and acquisitions. The book was honored as one of the “Top 10 Most Influential Finance Books of 2020.” The extensive work done in translating these two books has laid a solid theoretical foundation for the creation of this book.

In April 2018, MCG officially registered its first pure A-share private securities fund with the China Securities Investment Fund Association. The fund was named MCG Outstanding High-Dividend Value Growth Private Securities Investment Fund and combines the classic value investing principles with MCG’s “VMMIG Model,” tailored for the unique characteristics of the Chinese capital market. This model is being applied in the investment practices in the A-share market. According to data from Wind Information, over the course of the past four and a half years, in the highly volatile environment of the A-share market, the fund has achieved a compounded annual investment return of 19.5% after experiencing two major declines in 2018 and 2022. This performance ranks the fund in the top 5% among more than 13,500 funds of the same type. This has bolstered Dr Qi’s confidence in the application of the Chinese characteristic valuation model and in avoiding the “valuation trap” when investing in China. He hopes that the “VMMIG Model” will continue to thrive in the practice of the Chinese characteristic capital market.

Selected Reader’s Comments

Catalogs

Access to books

If you are interested in purchasing this book, please contact Ms. Yu

(cell phone number/WeChat number: 18710061706) for a favorable price.

The company has a small number of Dr. Chi's signed and stamped edition, pre-order quickly!

(Disclaimer: The information, opinions, valuations and forecasts contained in this book are for reference only and do not constitute independent research or advice. The valuation and other views contained in this book are based on a series of assumptions and prerequisites and do not constitute advice or recommendations to anyone. The stock market involves risks and investment should be made with caution.)